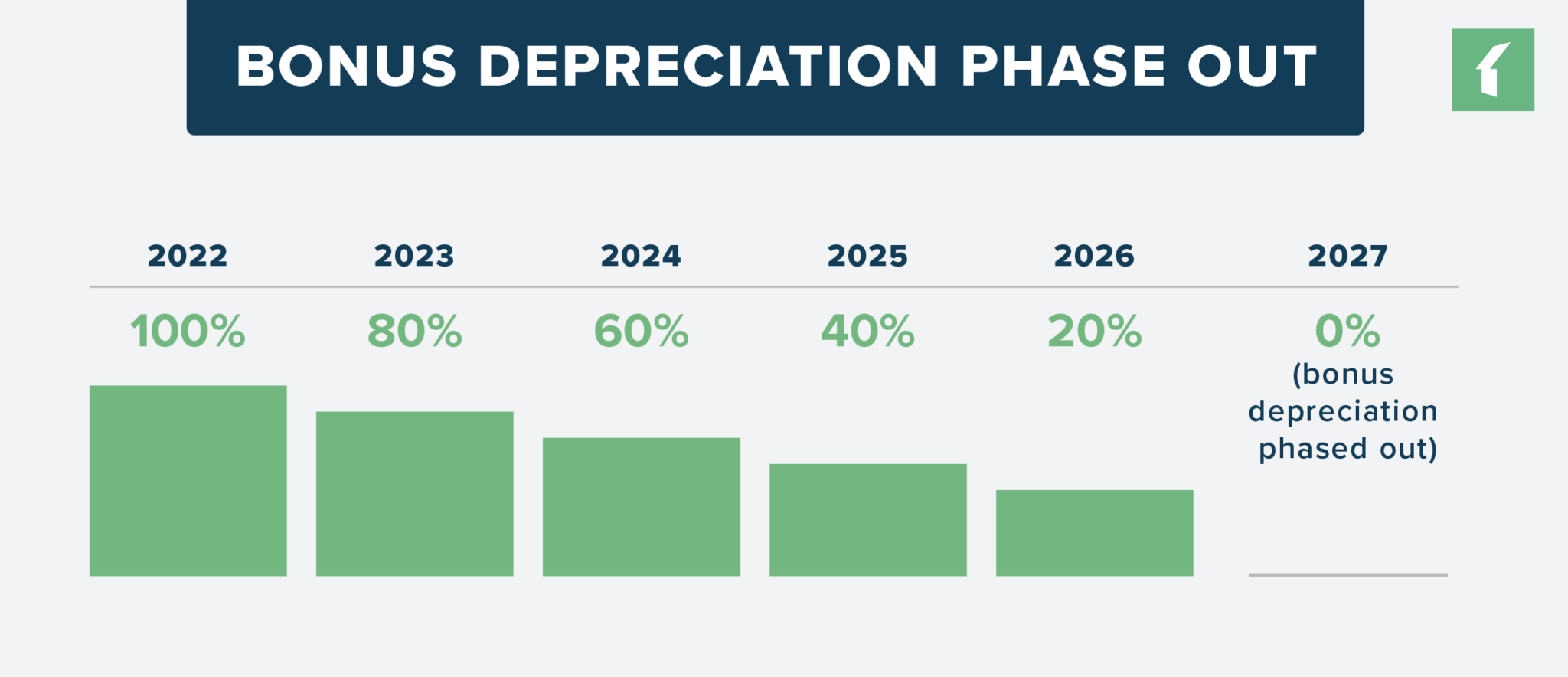

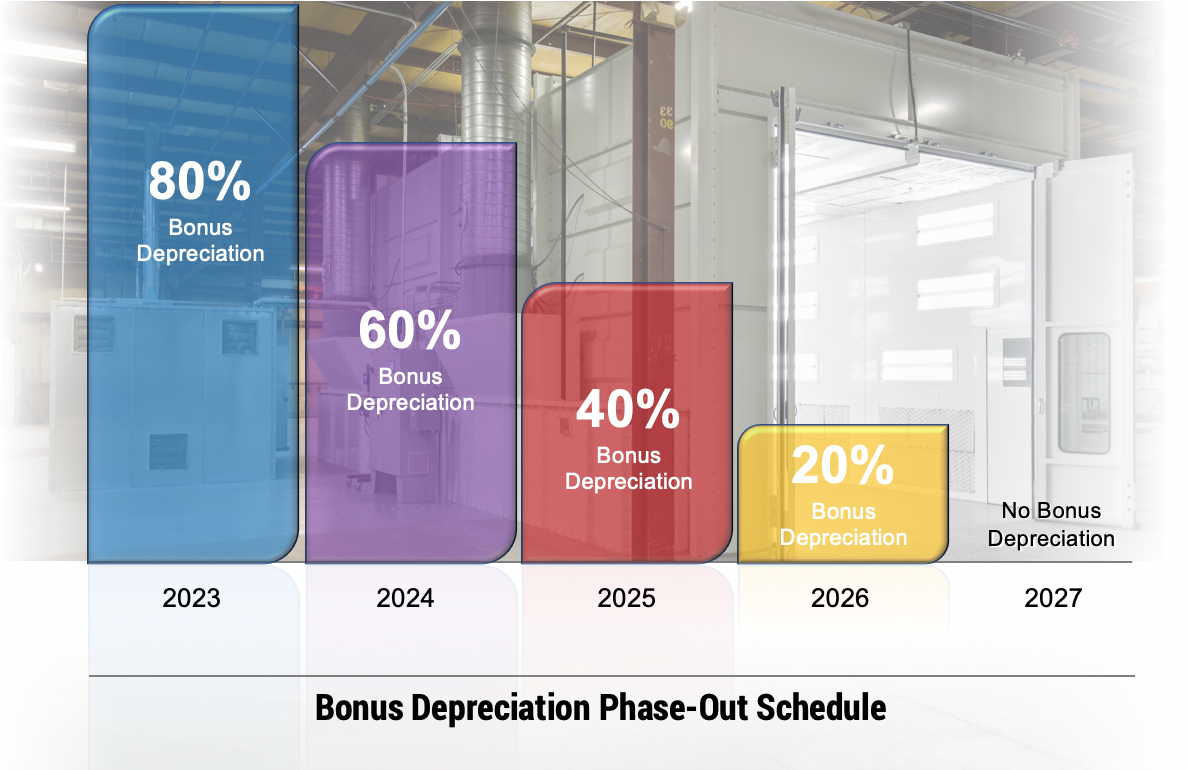

Federal Bonus Depreciation 2025. Bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery,. The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2025, 40% for 2025, and 20% for 2026.

Even with bonus depreciation, taxpayers run the risk of dealing with depreciation recapture (where they must report previously taken depreciation as ordinary. Meanwhile, the limitation on deducting pass.

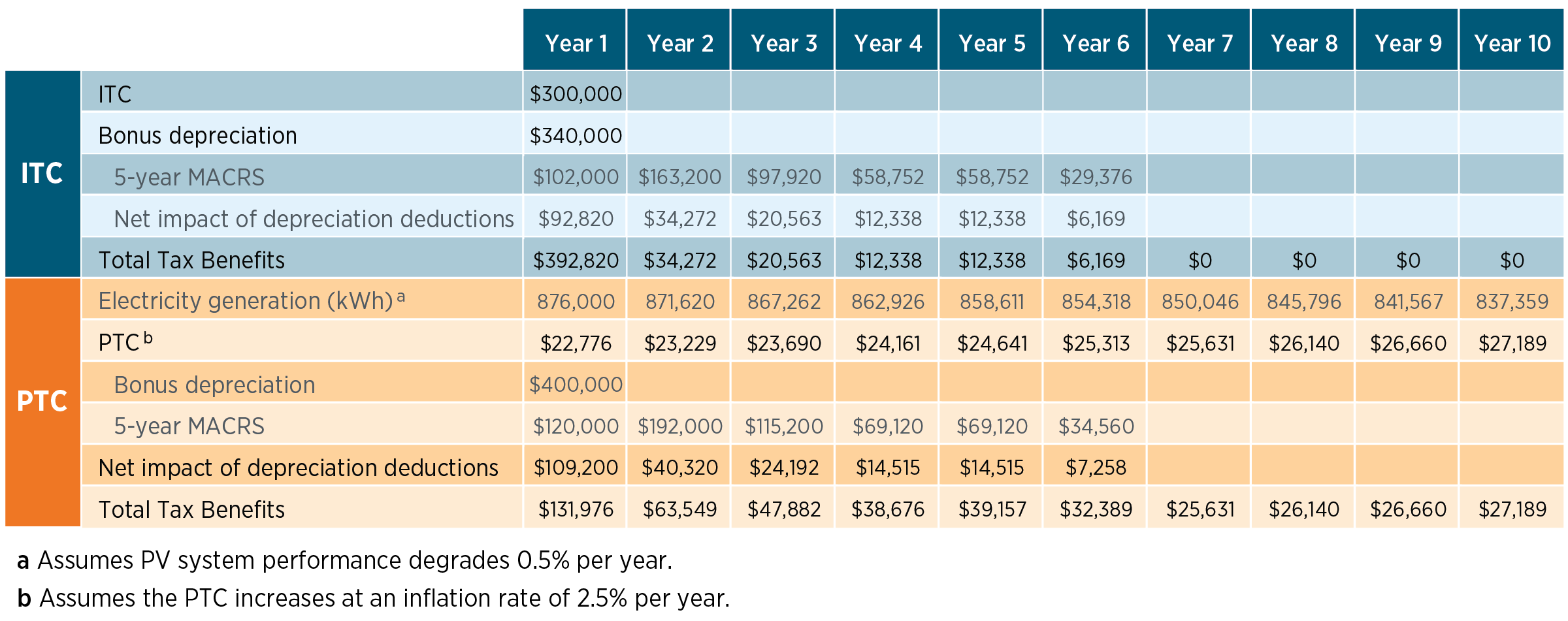

Federal Solar Tax Credits for Businesses Department of Energy, Bonus depreciation ultimately lowers the cost of capital investment and leads to more jobs, higher wages, and increased productivity. It now moves to the senate with significant momentum but an uncertain fate.

8 ways to calculate depreciation in Excel (2025), The rate of bonus depreciation continues to phase down, with eligible assets acquired and placed in service in 2025 eligible for 60% bonus depreciation before it. The allowable percentage is set to decrease in 20% increments every year through 2027, meaning bonus depreciation is set at 60% for 2025, 40% for 2025, and 20% for 2026.

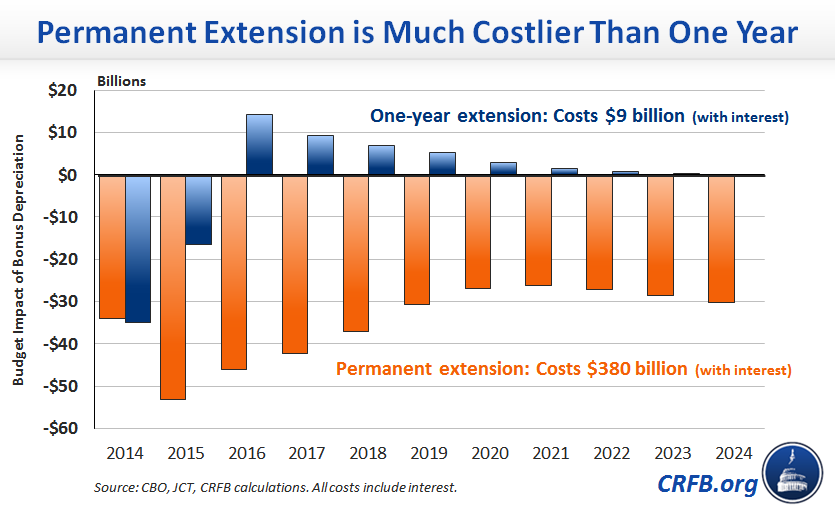

Paying the Costs of Bonus Depreciation Committee for a Responsible, 7024, the tax relief for american families and workers act of 2025, which includes 100% bonus depreciation,. Specific provisions in the bill:

What Is Bonus Depreciation A Small Business Guide, 179 deduction for tax years beginning in 2025 is $1.22 million. The full house passed late wednesday by a 357 to 70 vote h.r.

Bonus Depreciation Saves Property Managers Money Buildium, Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant. Meanwhile, the limitation on deducting pass.

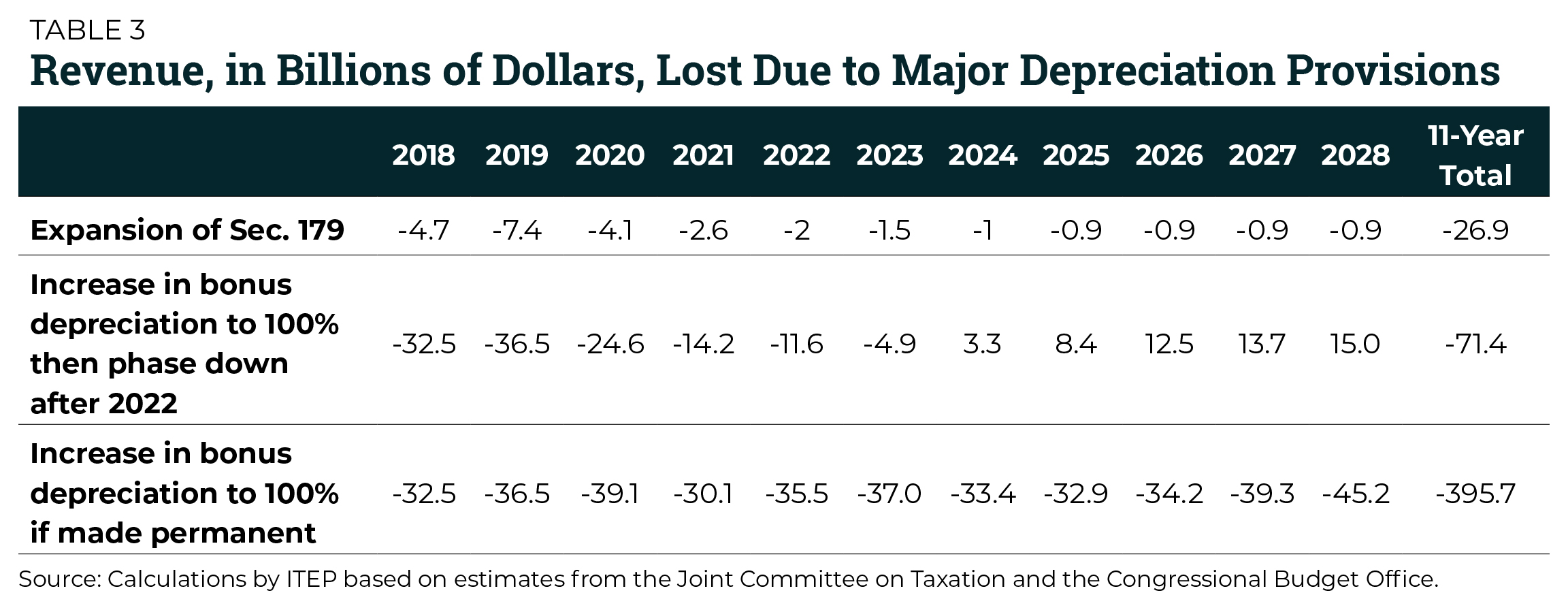

The Failure of Expensing and Other Depreciation Tax Breaks ITEP, On may 29, 2025, the treasury department and the. 0% how does bonus depreciation work?

Federal Bonus and State Depreciation YouTube, Bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery,. Additionally, there is no business income limit, so.

Bonus Depreciation vs. Section 179 What's the Difference? (2025), The rate of bonus depreciation continues to phase down, with eligible assets acquired and placed in service in 2025 eligible for 60% bonus depreciation before it. Bonus depreciation ultimately lowers the cost of capital investment and leads to more jobs, higher wages, and increased productivity.

Valuable Tax Savings on Capital Equipment Through Bonus Depreciation, Specific provisions in the bill: But good things do not always last forever.

How To Calculate Depreciation Deduction Haiper, The bill delays the beginning of the phaseout of 100% bonus depreciation from 2025 to 2026. But good things do not always last forever.

Bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery,.